cares act stimulus check tax refund

New 1100 stimulus checks are coming right now if. There will be a reduced amount given to individual taxpayers from 75001 99000 the payment amount will decrease by 5 for every 100 of income over 75000.

Where S My Third Stimulus Check The Turbotax Blog

2020 IRS Stimulus Checks Economic Impact Payments.

. Under the law the Fund is to be used to make payments for specified uses to States and certain local governments. On March 25 2020 Congress unanimously passed an economic stimulus package that allows for taxpayers to receive stimulus checks of up to 1200 per adult. The second stimulus check will be up to 600 per adult and 600 for each child dependent.

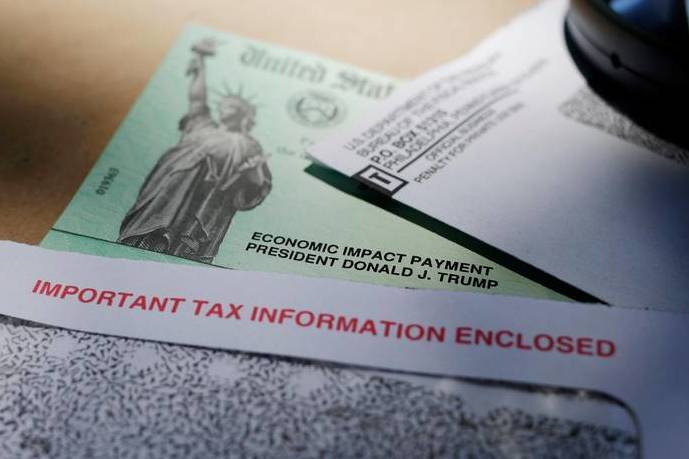

These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. Congress recently voted to authorize another round of stimulus checks due to the economic fallout from Covid-19. The 2021 tax season offers an opportunity to claim those payments if you never.

Within 10 days of receiving their checks people spent an average of. Now you would expect a 2200 refund 5300 paid minus the 3100. How people used the recent stimulus payments they received under the CARES Act hints at how they might use their tax refunds.

The District of Columbia and US. Any individual taxpayer who had an Adjusted Gross Income AGI of less than 75000 will get a payment of 1200. Who will get a CARES Act stimulus check.

There are income limitations to receiving a stimulus check see below but the amount you will receive is 1200 for a Single taxpayer or 2400 for a married filing joint taxpayer. Key Cares Credits. It is not considered income and it not taxed.

State residents who have filed their 2021 return by June 30 will get a check for 750 by September 30 thanks to the 1992 Taxpayers Bill of Rights TABOR Amendment while joint filers. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. A child dependent is defined as a child that is 16 years old or younger.

Here are four things to know about the CARES Act. An additional amount of 500 per dependent child age 16 and younger at the end of the year of the tax return they are looking at will be sent as well ex. With the CARES Act you receive an additional credit for 1200 and your tax liability is lowered from 4300 to 3100.

You may soon receive a 1200 or 2400 stimulus check from the government if you set up your tax refund with direct deposit though it will be a longer wait if you need a paper check. COVID-19 Stimulus Checks for Individuals. With the CARES Act you receive an additional credit for 1200 and your tax liability is lowered from 4300 to 3100.

600 in December 2020January 2021. 30-day temporary credit provided to clients receiving stimulus checks into an account with a negative balance of greater than 50 to allow full access to the stimulus payment. Taxpayers who have filed tax returns for 2018 or 2019 and who have authorized direct deposit.

The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund. New stimulus checks are available in all these states check if youre eligible. 2019 tax returns they look at age as of.

The government has deployed most of the third round of stimulus checks in amounts of up to 1400 per person. 1200 in April 2020. On April 11 2020 the IRS began its first wave of payments.

Territories consisting of the. 1400 in March 2021. There is no cap on the.

If you did not receive your first andor second stimulus payment or if the amount received is not correct you can claim it on your 2020 tax return as the Recovery Rebate Credit. It is reportable for the purpose of reconciling that you received the correct amount. Now you would expect a 2200 refund 5300 paid minus the 3100.

How to sign up for 2022 stimulus checks worth up to 8000. Permanent credits given to forgive overdrawn balances for clients receiving stimulus checks into an account with a negative balance of 50 or less.

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Stimulus Check 2 Deposit Where Is My 600 Stimulus Payment Forbes Advisor

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

Social Security Recipients To Get Stimulus Checks No Tax Return Needed Payroll Taxes Income Tax Return Tax Return

5 Smart Ways To Invest Your Stimulus Check

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Trump Signs Covid Relief Bill 600 Stimulus Checks Go Out This Week

Get My Payment Irs Portal For Stimulus Check Direct Deposit Money

Irs Admits Mistake In Noncitizens Receiving 1 200 Coronavirus Stimulus Checks Npr

Child Tax Credit And 3rd Stimulus Watch For These Irs Letters 11alive Com

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Will I Get A Stimulus Check If I Owe Taxes And Other Faqs Bench Accounting

Stimulus Updates To Know For Spring 2022 Gobankingrates

How To Get A College Student Stimulus Check 2022

600 Second Stimulus Check Calculator Forbes Advisor

Abc News Lawsuit Reveals How Trump S Name Ended Up On Covid Checks

Second Stimulus Check Update Monday May 11 Cares Act 2 Coming Soon Youtube Second Stimulus Check Stimulus Check Acting

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos